The march toward legalization continued with the launch of adult-use sales in Ohio. Ohio was a $500MM medical market with very low medical patient penetration. Pennsylvania has a similar population with a medical program more than triple in size at $1.5BN. As a result of this low medical penetration, we expect to see a strong 2.5-3.0x multiplier on medical sales, which will benefit incumbent players including a few of our borrowers.

Location is the name of the game

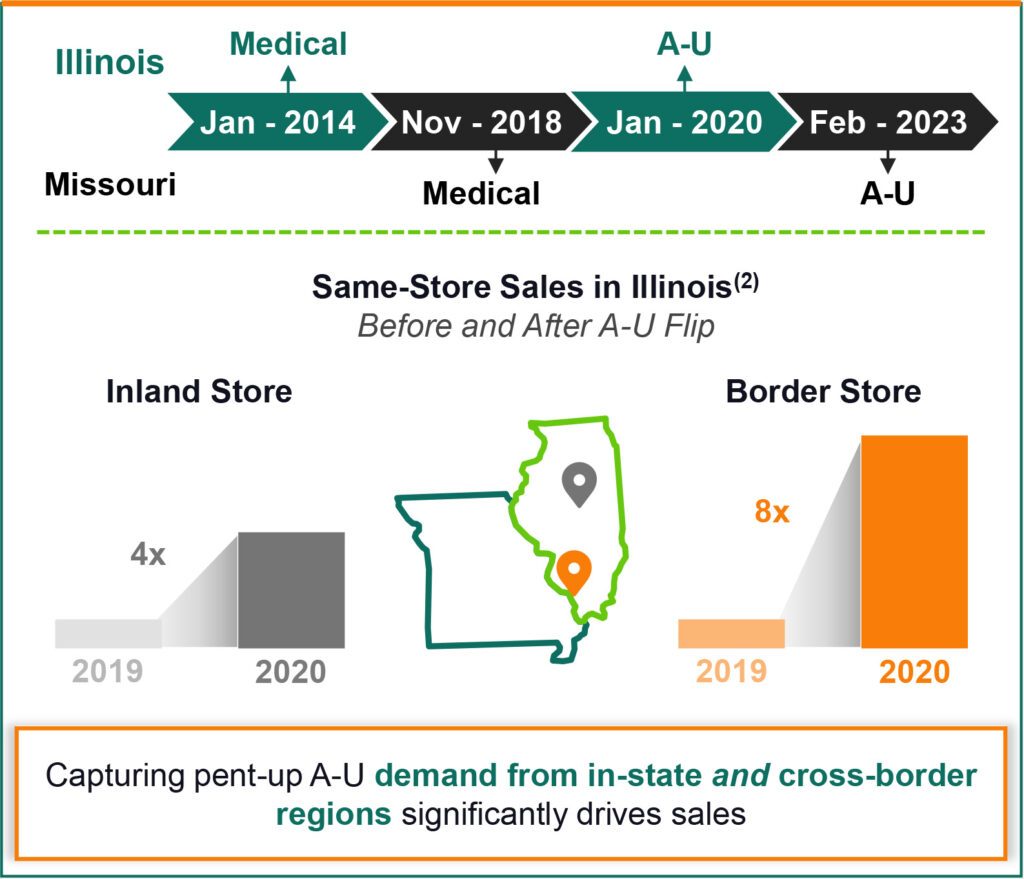

In retail and this will play a critical role in Ohio at both the micro as well as macro level. At the micro level, operators’ local ground games will be critically important with some municipalities adopting temporary or permanent moratoriums on cannabis dispensaries and other municipalities leaving zoning wide open. At the macro level, we expect Cincinnati and Indiana border dispensaries to do exceptionally well.

“At the macro level, we expect Cincinnati and Indiana border dispensaries to do exceptionally well.”

On the flip side, we expect dispensaries in the northwest quadrant of the state to significantly underperform as super-consumers will make the trek to Michigan to buy product at a 75% (and growing) discount. Like many adult-use flips, we anticipate that retail performance will moderate over the course of 2025 as an additional 196 dispensary licenses come online alongside the existing 135 dispensaries. These details will matter to companies performance and we expect a wide divergence in individual dispensary unit economics given the factors mentioned above.

Substantial Potential Uplift in Border Stores

On the wholesale front

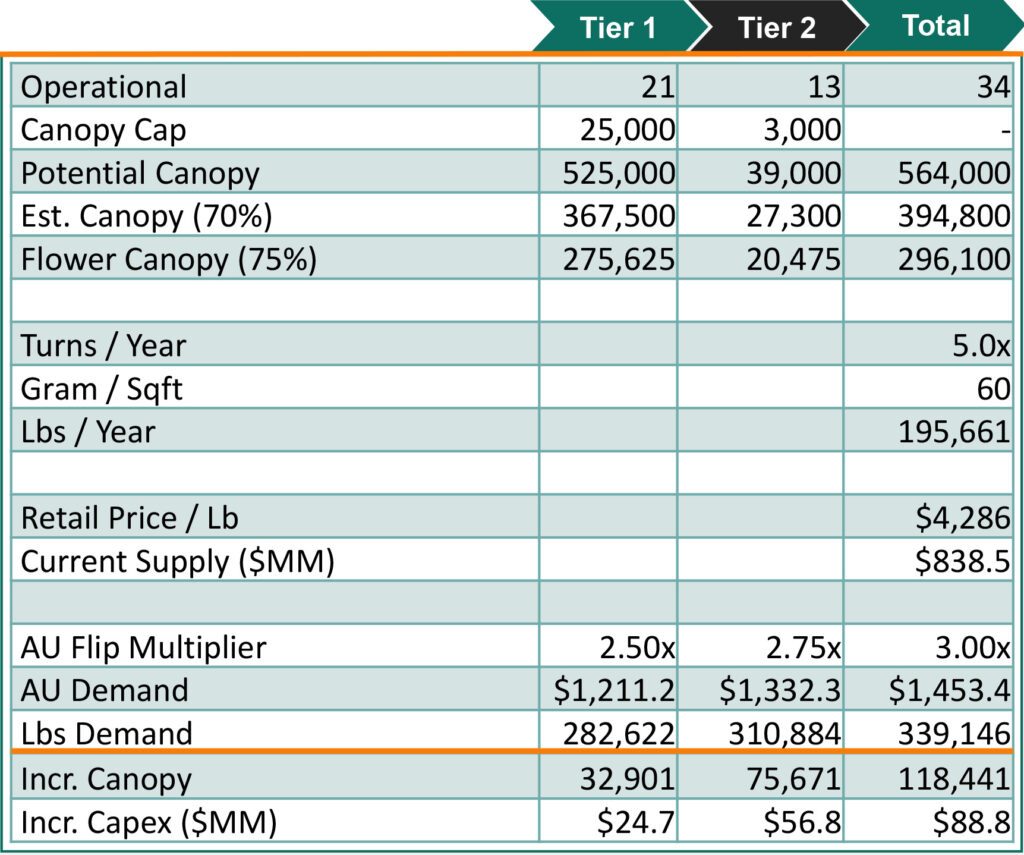

We expect wholesale to remain stronger for longer given the current capacity in the market and lack of capital availability for cultivation expansions and buildouts. Historically, investment in Ohio cultivation capacity was more muted given the smaller size of the medical market and tight canopy caps of 25K sqft for the 21 Tier 1 licensees and 3K sqft for the 13 Tier 2 licensees. This equates to total potential canopy of 564K sqft. For reference, the canopy cap for the 21 regular cultivation licenses in Illinois is 210K sqft each. Operators could apply to expand beyond these caps or tier their cultivations, but such expansions were the rare exception rather than the rule and we estimate the market has not built out to it’s full potential under the old caps. While canopy caps have been expanded under AU to 100K and 15K sqft respectively, we expect the capital intensity of cultivation expansions combined with the lack of capital availability to temper cultivation expansions in the medium term. This should provide a favorable wholesale setup as the market expands by 2.5-3.0x and retail density increases.

“Under the current regulatory framework, each state is it’s own country with unique supply-demand dynamics.”

Wholesale Supply / Demand Analysis

Under the current regulatory framework, each state is it’s own country with unique supply-demand dynamics. At AFC, cannabis is our sole focus and we sweat these details in our underwriting. We believe Ohio will be an important market for many operators over the coming year and are excited to selectively deploy capital to support its growth.

Capital Markets

Turning to capital markets, two of the larger Tier 2 public companies recently refinanced existing term loans both at an all-in yield of a little over 14%. One of these borrowers refinancing 2021 vintage debt at a 9.8% yield, resulting in 400bps increase in rate vs. 2021. This increase in yields is in part due to industry performance since 2021 and the increase in rates generally over the last two years. Additionally, there’s more to do in the low teens in regular way industries without the “federal illegality, sin industry” premium of cannabis. All else being equal, if public companies are issuing at 14%, then private companies generally should be wide. With that said, AFC is happy with returns we generate and are going to focus on moving up the quality curve while still achieving mid- to high-teens IRRs instead of reaching on yield.

“We expect the next crop of Tier 2 and especially Tier 3 refinancings will not be easy if the current capital drought persists.”

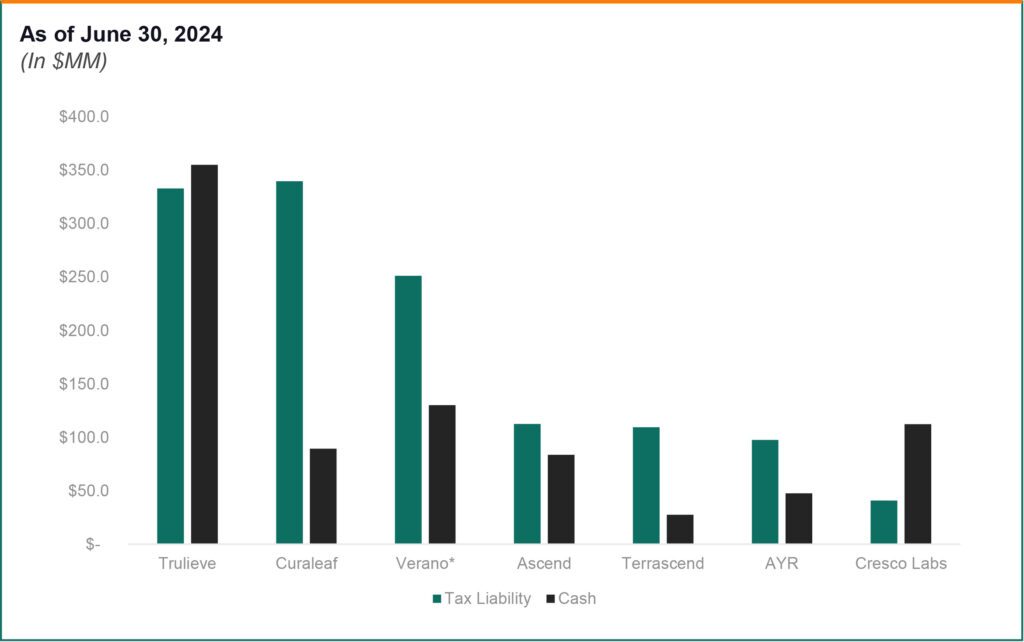

Tier 1s and 2s have $500MM of maturities in 2025 and $1.8BN of maturities in 2026. We expect the next crop of Tier 2 and especially Tier 3 refinancings will not be easy if the current capital drought persists.

Compounding the issue on these refinancings is the growing tax debt at the public MSOs. Many public companies have taken the position that 280E taxation does not apply and have gone a step further in filing amended returns for refunds of prior year 280E tax payments. The IRS took the extraordinary step of posting a bulletin rebuking this position in June 20241 and has opened up the amended returns of at least one public company to an audit. Interest and penalties on this tax debt could be quite significant and I don’t know that it’s wise to poke this bear. If the IRS begins to respond more aggressively, the cash flow tailwind of tax non-payment over the last 2 year could turn into a headwind of forced repayment.

Between these refinancings, adult-use and medical expansions and the recent uptick in M&A activity, we expect demand for debt capital to remain robust and the supply-demand imbalance for debt capital to persist.

Wholesale Supply / Demand Analysis

Borrower Spotlight

We’re previously highlighted our thesis that what we call Cannabis 3.0 operators will provide a fruitful pipeline of investment opportunity. These are entrepreneurs that have founded businesses in cannabis or other industries, had success and are now (re)entering the cannabis industry. These operators that have clean capital stacks unburdened with debt, sale-leasebacks or tax debt and are well positioned to go on the offensive, when many legacy operators are on their back foot.

In March 2024, we made a $34MM to Sunburn Cannabis a vertically integrated operator in Florida. Brady Cobb and the team at Sunburn exemplify our Cannabis 3.0 thesis. After scaling and selling OnePlant to Cresco Labs in 2021 for $213MM, Brady acquired MedMen’s Florida vertical in August 2022 and got the OnePlant band back together again. The team has been hard over the last two years resetting and scaling its cultivation facilities, launching the Sunburn brand, and opening additional dispensaries.

“The Sunburn brand has resonated with Florida consumers”

The Sunburn brand has resonated with Florida consumers and the quality of its products combined with hyper-local activations and community engagement continues to bring new customers to its stores week-after-week. While there is optimism that adult-use in Florida, which is on the ballot and polling well, becomes a reality in November 2024, Brady and the Sunburn team have proven themselves adept at taking market share in a market with stagnant patient growth. Last week, Sunburn raked #1 in milligrams of THC and #3 in ounces of flower sold per store and is on par with or outselling operators with more than double their store count. The Sunburn team has additional locations slated to open this year and we expect they’ll continue to take market share if the market remains medical. If adult-use passes, we expect the company’s adult-use ready stores will be outsized beneficiaries of the flip and AFC stands ready to expand alongside them as a financing partner.

Brady Cobb, Founder and CEO of Sunburn Cannabis

1IRS: Marijuana remains a Schedule I controlled substance; Internal Revenue Code Section 280E still applies | Internal Revenue Service